Greenwicher's WikiFRM - Financial Markets and Products 2017-10-30

[Last Update: Nov 7, 2017]

Banks

Types of Banks

- Commercial banks

- Investment banks

Major Risks Faced by Banks

LO 31.1: Identify the major risks faced by a bank.

- credit risk

- market risk

- operational risk

Economic Capital vs. Regulatory Capital

LO 31.2: Distinguish between economic capital and regulatory capital.

Deposit Insurance and Moral Hazard

LO 31.3: Explain how deposit insurance gives rise to a moral hazard problem.

Investment Banking Financing Arrangements

LO 31.4: Describe investment banking financing arrangements including private placement, public offering, best efforts, firm commitment, and Dutch auction approaches.

Poential Conflicts of Interest

LO 31.5: Describe the potential conflicts of interest among commercial banking, securities services, and investment banking divisions of a bank and recommend solutions to the conflict of interest problems.

Banking Book vs. Trading Book

LO 31.6: Describe the distinctions between the “banking book” and the “trading book” of a bank.

The Originate-to-Distribute Model

LO 31.7: Explain the originate-to-distribute model of a bank and discuss its benefits and drawbacks.

Insurance Companies and Pension Plans

Categories of Insurance Companies

LO 32.1: Describe the key features of various categories of insurance companies and identify the risks facing incusrance companies.

Life Insurance

Property and Casualty (P&C) Insurance

Health Insurance

Risks Facing Inssurance Companies

- Insufficient funds to satisfy policyholder’s claim

- poor return on investment

- liquidity risk of investments

- credit risk

- operational risk

Mortality Tables

LO 32.2: Describe the use of mortality tables and calculate the premium payment for a policy holder.

P&C Insurance Ratios

LO 32.3: Calculate and interpret loss ratio, expense ratio, combined ratio, and operating ratio for a property-casualty insurance company.

Moral Hazard and Adverse Selection

LO 32.4: Describe moral hazard and adverse selection risks facing insurance companies, provide examples of each, and describe how to overcome the problems.

Mortality Risk vs. Longevity Risk

LO 32.5: Distinguish between mortality risk and longevity and describe how to hedge these risks.

Hedging Mortality and Longevity Risks

Capital Requirements for Insurance Companies

LO 32.6: Evaluate the capital requirements for life insurance and property-casualty insurance companies.

Guaranty System For Insurance Companies

LO 32.7: Compare the guaranty system and the regularoty requirements for insurance companies with those for banks.

Pension Funds

LO 32.8: Describe a defined benefit plan and a defined contribution plan for a pension fund and explain the differences between them.

Mutual Funds and Hedge Funds

Types of Mutual Funds

LO 33.1: Differentiate among open-end mutual funds, closed-end mutual funds, and exchange -traded funds (ETFs).

Net Asset Value

LO 33.2: Calculate the net asset value (NAV) of an open-end mutual fund.

Hedge Funds vs. Mutual Funds

LO 33.3: Explain the key differences between hedge funds and mutual funds.

Hedge Fund Expected Returns and Fee Structures

LO 33.4: Calculate the return on a hedge fund investment and explain the incentive fee structure of a hedge fund including the terms hurdle rate, high-water mark and clawback.

Hedge Fund Strategies

LO 33.5: Describe various hedge fund strategies, including long/short equity, dedicated short, distressed securities, merger arbitrage, convertible arbitrage, fixed income arbitrage, emerging markets, global macro, and managed futures, and idenfity the risks faced by hedge funds.

Hedge Fund Performance and Measurement Bias

LO 33.6: Describe hedge fund performance and explain the effect of measurement biases on performance measurement.

Introduction (Options, Futures, and Other Derivatives)

Derivative Markets

LO 34.1: Describe the over-the-counter market, distinguish it from trading on an exchange, and evaluate its advantages and disadvantages.

Basics of Derivative Securities

LO 34.2: Differentiate between options, forwards, and futures contracts.

LO 34.3: Identify and calculate option and forward contract payoffs.

Hedging Strategies

LO 34.4: Calculate and compare the payoffs from hedging strategies involving forward contracts and options.

Speculative Strategies

LO 34.5: Calculate and compare the payoffs from speculative strategies involving futures and options.

Arbitrage Opportunities

LO 34.6: Calculate an arbitrage payoff and describe how arbitrage opportunities are temporaty.

Risk from Derivatives

LO 34.7: Describe some of the risks that can arise from the use of derivatives.

Mechanics of Futures Markets

LO 35.1: Define and describe the key features of a futures contract, including the asset, the contract price and size, delivery, and limits.

LO 35.9: Compare and contrast forward and futures contracts.

Futures/Spot Convergence

LO 35.2: Explain the convergence of futures and spot prices.

Operation of Margins

LO 35.3: Describe the rationale for margin requirements and explain how they work.

Clearinghouses in Futures Transactions

LO 35.4: Describe the role of a clearinghouse in futures and over-the-counter market transactions.

Over-the-Counter Markets

LO 35.5: Describe the role of collateralization in the over-the-counter market and compare it to the margining system.

Normal and Inverted Futures Market

LO 35.6: Identify the differences between a normal and inverted futures market.

The Delivery Process

LO 35.7: Describe the mechanics of the delivery process and contrast it with cash settlement.

Types of Orders

LO 35.8: Evaluate the impact of different trading order types.

Regulatory, Accounting, and Tax Frameworks

Hedging Strategies Using Futures

Hedging with Futures

LO 36.1: Define and differentiate between short and long hedges and identify their appropriate uses.

Advantages and Disadvantages of Hedging

LO 36.2: Describe the arguments for and against hedging and the potential impact of hedging on firm profitability.

Basis Risk

LO 36.3: Define the basis and explain the various sources of basis risk, and explain how basis risks arise when hedging with futures.

LO 36.4: Define cross hedging, and compute and interpret the minimum variance hedge ratio and hedge effectiveness.

- $HR = \rho{\mbox{spot, futures}} \frac{\sigma{\mbox{spot}}}{\sigma_{\mbox{futures}}}$

The Optimal Hedge Ratio

Hedging with Stock Index Futures

LO 36.5: Compute the optimal number of futures contracts needed to hedge an exposure, and explain and calculate the “tailing the hedge” adjustment.

- # of contracts = $\beta_{\mbox{portfolio}} \frac{\mbox{portfolio value}}{\mbox{futures price * contract multiplier}}$

Adjusting the Portfolio Beta

LO 36.6: Explain how to use stock index futures contracts to change a stock portfolio’s beta.

- # of contracts = $(\beta^{} - \beta) \frac{\mbox{portfolio value}}{\mbox{value of futures contract}}$

Rolling a Hedge Forward

LO 36.7: Explain the term “rolling the hedge forward” and describe some of the risks that arise from this strategy.

Interest Rates

Types of Rates

LO 37.1: Describe Treasury rates, LIBOR, and repo rates, and explain what is meant by the “risk-free” rate

Compounding

LO 37.2: Calculate the value of an investment using different compounding frequences

LO 37.3: Convert interest rates based on different compounding frequencies

Spot (Zero) Rates and Bound Pricing

LO 37.4: Calculate the theoretical price of a bond using spot prices

Bond Pricing

Boud Yield

Bootstrapping Spot Rates

Forward Rates

LO 37.5: Derive forward interest rates from a set of spot rates.

Forward Rate Agreements

LO 37.6: Derive the value of the cash flows from a forward rate agreement (FRA)

Duration

LO 37.7: Calculate the duration, modified duration and dollar duration of a bond

Convexity

LO 37.8: Evaluate the limitations of duration and explain how convexity addresses some of them.

Using Convexity to Improve Price Change Estimates

LO 37.9: Calculate the change in a bond’s price given its duration, its convexity, and a change in interest rates.

Theories of the Term Structure

LO 37.10: Compare and contrast the major theories of the term structure of interest rates.

Determination of Forward and Future Prices

Investment and Consumption Assets

LO 38.1: Differentiate between investments and consumption assets.

Short-Selling and Short Squeeze

LO 38.2: Define short-selling and calculate the net profit of a short sale of a dividend-paying stock.

Forward and Futures Contracts

LO 38.3: Describe the differences between forward and futures contracts and explain the relationship between forward and spot prices.

LO 38.4: Calculate the forward price given the underlying asset’s spot price, and describe an arbitrage argument between sport and forward prices.

LO 38.9: Calculate, using the cost-of-carry model, forward prices where the underlying asset either does or does not have interim cash flows.

Forward Prices

Forward Price with Carrying Costs

The Effect of a Known Dividend

Value of a Forward Contract

Currency Futures

LO 38.6: Calculate a forward foreign exchange rate using the interest rate parity relationship.

Forward Prices vs. Future Prices

LO 38.5: Explain the relationship between forward and futures prices.

Commodity Futures

LO 38.7: Define income, storage costs, and convenience yield.

LO 38.8: Calculate the futures price on commodities incorporating income/storage costs and/or convenience yields.

Income and Storage Costs

Convience Yield

Delivery Options in the Futures Market

LO 38.10: Describe the various delivery options available in the futures markets and how they can influence futures prices.

Futures and Expected Future Spot Prices

LO 38.11: Explain the relationship beween current future prices and expected future spot prices, including the impact of systematic and nonsystematic risk.

Cost of Carry vs. Expectations.

Contango and Backwardation

LO 38.12: Define and interpret contango and backwardation, and explain how they relation to the cost-of-carry model.

- contango: futures price > current spot price

- backwardation: opposite of the above

Interest Rate Futures

Day Count Conventions

LO 39.1: Identify the most commonly used day count conventions, describe the markets that each one is typically used in, and apply each to an interest calculation

- T-bond: actual/actual

- corporate bond & municipal bonds: 30/360

- money market instruments: actual/360

Quotations for T-Bonds

LO 39.3: Differentiate between the clean and dirty price for a US Treasury bond; calculate the accrued interest and dirty price on a US Treasury bond.

- dirty price = clean price + accrued interest

Clean and Dirty Prices

###Quotations for T-Bills

LO 39.2: Calculate the conversion of a discount rate to a price for a US Treasury bill.

Treasury Bond Futures

LO 39.4: Explain and calculate a US Treasury bond futures contract conversion factor.

LO 39.5: Calculate the cost of delivering a bond into a Treasury bond futures contract.

LO 39.6: Describe the impact of the level and shape of the yield curve on the cheapest-to-deliver Treasury bond decision.

Cheapest-to-Deliver Bond

Treasury Bond Futures Price

LO 39.7: Calculate the theoretical futures price for a Treasury bond futures contract.

European Futures

LO 39.8: Calculate the final contract price on a Eurodollar futures contract.

LO 39.9: Describe and compute the Eurodollar futures contract convexity adjustment.

Convexity Adjustment

LO 39.10: Explain how Eurodollar futures can be used to extend the LIBOR zero curve.

Duration-based Hedging

LO 39.11: Calculate the duration-based hedge ratio and create a duration-based hedging strategy using interest rate functions.

- number of contracts = $-\frac{\mbox{portfolio of value duration of portfolio}}{\mbox{futures value duration of futures}}$

Limitations of Duration

LO 39.12: Explain the limitations of using a duration-based hedging strategy.

Swaps

Mechanics of Interest Rate Swaps

LO 40.1: Explain the mechanics of a plain vanilla interest rate swap and compute its cash flows.

LO 40.2: Explain how a plain vanilla interest rate swap can be used to transform an asset or a liability and calculate the resulting cash flows.

Financial Intermediaries

LO 40.3: Explain the role of financial intermediaries in the swaps market.

LO 40.4: Describe the role of the confirmation in a swap transaction.

Comparative Advantage

LO 40.5: Describe the comparative advantage argument for the esistence of interest rate swaps and evaluate some of the criticisms of this argument.

Problems with Comparative Advantage

Valuing Interest Rate Swaps

LO 40.6: Explain how the discount rates in a plain vanilla interest rate swap are computed.

Valuing an Interest Rate Swap with Bonds

LO 40.7: Calculate the value of a plain vanilla interest rate swap based on two simultaneous bond positions.

Valuing an Interest Rate Swap with FRAs

LO 40.8: Calculate the value of a plain vanilla interest rate swap from a sequence of forward rate agreements (FRAs).

Currency Swaps

LO 40.9: Explain the mechanics of a currency swap and compute its cash flows.

LO 40.11: Calculate the value of a currency swap based on two simultaneous bond positions.

LO 40.12: Calculate the value of a currency swap based on a sequence of FRAs.

Using a Currency Swap to Transform Existing Positions

LO 40.10: Explain how a currency swap can be used to transform an asset or liability and calculate the resulting cash flows.

Comparative Advantage

Swap Credit Risk

LO 40.13: Describe the credit risk exposure in a swap position

Other Types of Swaps

LO 40.14: Identify and describe other types of swaps, including commodity, volatility and exotic swaps.

Mechanics of Options Markets

Option Types

LO 41.1: Describe the types, position variations, and typical underlying assets of optioins.

- Call options

- Put options

- Underlying assets

- stock options

- currency options

- index options

Stock Options Specifications

LO 41.2: Explain the specification of exchange-traded stock option contracts, including that of nonstandard products.

- expiration

- strike prices

- moneyness, time value, and intrinsic value

Nonstandard Products

The Effect of Dividends and Stock Splits

Position and Exercise Limits

Option Trading

LO 41.3: Describe how trading, commissions, margin requirements, and exercise typically work for exchange-traded options.

Properties of Stock Options

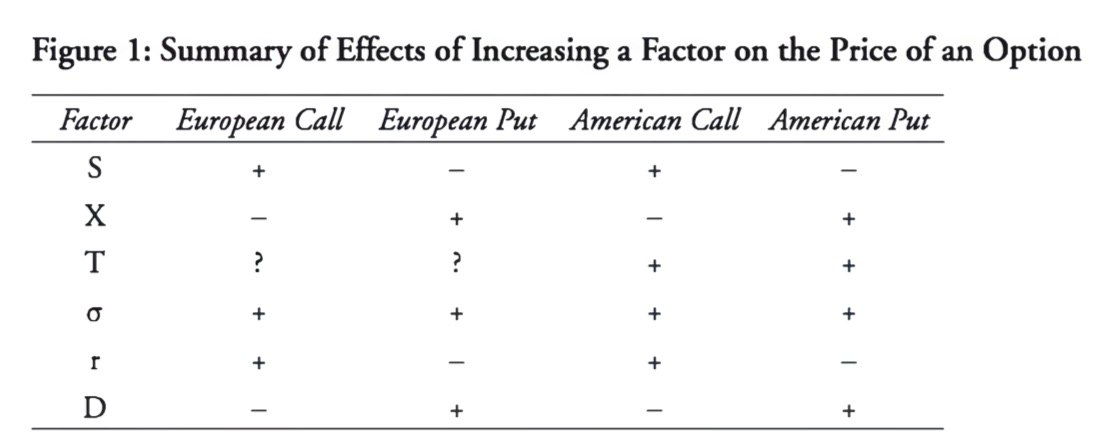

Six Factors that Affect Option Prices

LO 42.1: Identify the six factors that affect an option’s price and describe how these six factors affect the price for both European and American options.

- current stock price

- strike price

- time to maturity

- short-term risk-free interest

- present value of the dividend of the underlying stock

- expected volatility of stock prices

Upper and Lower Pricing Bounds

LO 42.2: Identify and compute upper and lower bounds for option prices on non-dividend and dividend paying stocks.

Computing Option Values Using Put-Call Parity

LO 42.3: Explain put-call parity and apply it to the valuation of European and American stock options.

- $c + Xe^{-rT} = S + p$

Lower Pricing Bounds for an American Call Option on A Nondividend-paying Stock

LO 42.4: Explain the early exercise features of American call and put options.

- do not exercise an American call option on nondividend-paying stock prior to expiration

Lower Pricing Bounds for an American Put Option on A Nondividend-paying Stock

Relationship Between American Call Options and Put Options

The Impact of Dividends on Option Pricing Bounds

Impact of Dividends of Early Exercise for American Calls and Put-Call Parity

Trading Strategies Involving Options

Covered Calls and Protective Puts

LO 43.1: Explain the motivation to initiative a covered call or a protective put strategy.

Spread Strategies

LO 43.2: Describe the use and calculate the payoffs of various spread strategies.

Combination Strategies

LO 43.3: Describe the use and explain the payoff functions of combination strategies.

Exotic Options

Evaluating Exotic Options

LO 44.1: Define and contrast exotic derivatives and plain vanilla derivatives.

LO 44.2: Describe some of the factors that derive the development of exotic products.

Using Packages to Formulate a Zero-cost Product

LO 44.3: Explain how any derivative can be converted into a zero-cost product

LO 44.4: Describe how standard American options can be transformed into nonstandard American options.

Exotic Option Payoff Structures

LO 44.5: Identify and describe the characteristics and pay-off structure of the following exotic options: gap, forward start, compound, chooser, barrier, binary, lookback, shout, Asian, exchange, rainbow, and basket options.

Volatility and Variance Swaps

Lo 44.6: Describe and contrast volatility and variance swaps.

Issues in Hedging Exotic Options

LO 44.7: Explain the basic premise of static option replication and how it can be applied to exotic options.

Commodity Forwards and Futures

Pricing Commodity Forward and Futures

LO 45.1: Apply comodity concepts such as storage costs, carry markets, lease rate, and convenience yield.

LO 45.2: Explain the basic equilibrium formula for pricing commodity forwards.

LO 45.13: Explain how to create a synthetic commodity position, and use it to explain the relationship between the forward price and the expected future spot price.

Commodity Arbitrage

LO 45.3: Describe an arbitrage transaction in commodity forwards, and compute the potential arbitrage profit.

Lease Rates

LO 45.4: Define the lease rate and explain how it determines the no-arbitrage values of commodity forwards and futures.

Contango and Backwardation

Storage Costs

LO 45.5: Define carry markets, and illustrate the impact of storage costs and convenience yields on commodity forward prices and no-arbitrage bounds.

LO 45.6: Compute the forward price of a commodity with storage costs.

Convinence Yield

Comparing Lease Rates, Storage Costs, and Convenience Yield

LO 45.7: Compare the lease rate with the convenience yield

Commodity Characteristics

LO 45.8: Identify factors that impact gold, corn, electricity, natural gas, and oil forward prices.

Commodity Spread

LO 45.9: Compute a commodity spread.

Basis Risk

LO 45.10: Explain how basis risk can occur when hedging commodity price exposure.

Strip Hedge vs. Stack Hedge

LO 45.11: Evaluate the differences between a strip hedge and a stack hedge and explain how these differences impact risk management.

Cross Hedging

LO 45.12: Provide examples of cross-hedging, specifically the process of hedging jet fuel with crude oil and using weather derivatives.

Exchanges, OTC Derivatives, DPCs and SPVs

Exchange Functions

LO 46.1: Describe how exchanges can be used to alleviate counterparty risk.

Forms of Clearing

LO 46.2: Explain the developments in clearing that reduce risk.

Exchange-Traded vs. OTC Derivatives

LO 46.3: Compare exchange-traded and OTC markets and describe their uses.

Classes of OTC Derivatives

LO 46.4: Identify the classes of derivatives securities and explain the risk associated with them.

Mitigating Risks of OTC Derivatives

LO 46.5: Identify risks associated with OTC markets and explain how these risks can be mitigated.

Basic Principles of Central Clearing

The Role of A Central Counterparty

LO 47.1: Provide examples of the mechanics of a central counterparty (CCP).

Central Clearing

LO 47.2: Describe advantages and disadvantages of central clearing of OTC derivatives.

Margining

LO 47.3: Compare margin requirements in centrally cleared and bilateral markets, and explain how margin can mitigate risk.

Novation and Netting

Lo 47.4: Compare and contrast bilateral markets to the use of novation and netting.

Impact of Central Clearing

LO 47.5: Assess the impact of central clearing on the broader financial markets

Risks Caused by CCPs

Risks Faced by Central Counterparties

LO 48.1: Identify and explain the types of risks faced by CCPs.

Risks to Clearing Members and Non-members

LO 48.2: Identify and distinguish between the risks to clearing members as well as non-members.

Lessons Learned from CCP Failures

LO 48.3: Identify and evaluate lessons learned from prior CCP failures.

Foreign Exchange Risk

Sources of Foreign Exchange Risk

LO 49.1: Calculate a financial institution’s overall foreign excahnge exposure.

LO 49.2: Explain how a financial institution could alter its net position exposure to reduce foreign exchange risk.

LO 49.3: Calculate a financial institution’s potential dollar gain or loss exposure to a particular currency.

Foreign Trading Activities

LO 49.4: Identify and describe the different types of foreign exchange trading activities.

Sources of Profits and Losses on Foreign Exchange Trading

LO 49.5: Identify the sources of foreign exchange trading gains and losses.

LO 49.6: Calculate the potential gain or loss from a foreign currency denominated investment.

Balance Sheet Hedging

LO 49.7: Explain balance-sheet hedging with forwards.

Off-balance Sheet Hedgin

LO 49.8: Drscribe how a non-arbitrage assumption in the foreign exchange markets leads to the interest rate parity theorem, and use this theorem to calculate forward foreign exchange rates.

Diversification in Multicurrency Foreign Asset-liability Positions

LO 49.10: Explain why diversification in multicurrency asset-liability positions could reduce portfolio risk.

LO 49.11: Describe the relationship between nominal and real interest rates.

Corporate Bonds

Bond Indenture and Role of Corporate Trustee

Lo 50.1: Describe a bond indenture and explain the role of the corporate trustee in a bond indenture.

Maturity Date

Lo 50.2: Explain a bond’s maturity date and how it impacts bond retirements.

Interest Payment Classifications

LO 50.3: Describe the main types of interest payment classifications.

- straight-coupon bonds

- zero-coupon bonds

- floating-rate bonds