Greenwicher's WikiFRM - Valuation and Risk Models 2017-11-07

[Last Update: Nov 10, 2017]

VaR Methods

Defining VaR

Calculating VaR

VaR Conversions

The VaR Methods

- Linear methods (the delta-normal valuation)

- Full valuation (Monte Carlo and historic simulation models)

Comparing the Methods

Quantifying Volatility in VaR Models

LO 52.1: Explain how asset return distributions tend to deviate from the normal distribution.

- fat-tailed

- skewed

- unstable

LO 52.2: Explain reasons for fat tails in a return distribution and describe their implications.

LO 52.3: Distinguish between conditional and unconditional distributions.

Market Regimes and Conditional Distributions

LO 52.4: Describe the implications of regimes switching on quantifying volatility.

Value at Risk

LO 52.5: Explain the various approaches for estimating VaR

LO 52.6: Compare and contrast different parametric and non-parametric approaches for estimating conditional volatility

LO 52.7: Calculate conditional volatility using parametric and non-parametric approaches

Parametric Approaches for VaR

GARCH

Nonparametric vs. Parametric VaR Methods

Nonparametric Approaches for VaR

- Historical Simulation Method

- Hybrid Approach

- Multivariate Density Estimation (MDE)

Return Aggregation

LO 52.8: Explain the process of return aggregation in the context of volatility forecasting methods.

Implied Volatility

LO 52.9: Evaluate implied volatility as a predictor of future volatility and its shortcomings.

Mean Reversion and Long Time Horizons

LO 52.10: Explain long horizon volatility/VaR and the process of mean reversion according to an AR(1) model.

LO 52.11: Calculate conditional volatility with and without mean reversion.

LO 52.12: Describe the impact of mean reversion on long horizon conditional volatility estimation.

Backtesting VaR Methodologies

Putting VaR to Work

Linear vs. Non-linear Derivatives

LO 53.1: Explain and give examples of linear and non-linear derivatives.

LO 53.2: Describe and calculate VaR for linear derivatives.

Taylor Approximation

LO 53.3: Describe the delta-normal approach for calculating VaR for non-linear derivatives.

LO 53.4: Describe the limitations of the delta-normal method.

The Delta-Normal and Full Revaluation Methods

LO 53.5: Explain the full revaluation method for computing VaR.

LO 53.6: Compare delta-normal and full revaluation approaches for computing VaR.

The Monte Carlo Approach

LO 53.7: Explain structured Monte Carlo, stress testing, and scenario analysis methods for computing VaR, and identify strengths and weaknesses of each approach.

LO 53.8: Describe the implications of correlation breakdown for scenario analysis.

Correlations during Crisis

Stress Testing

Worst Case Scenario Measure

LO 53.9: Describe worst-case scenario (WCS) analysis and compare WCS to VaR.

Measures of Financial Risk

Mean-Variance Framework

LO 54.1: Describe the mean-variance framework and the efficient frontier.

Mean-Variance Framework Limitations

LO 54.2: Explain the limitations of the mean-variance framework with respect to assumptions about the return distributions.

Value at Risk

LO 54.3: Define the Value-at-Risk (VaR) measure of risk, describe assumptions about return distributions and holding period, and explain the limitations of VaR.

Coherent Risk Measures

LO 54.4: Define the properties of a coherent risk measure and explain the meaning of each property.

Expected Shortfall

LO 54.5: Explain why VaR is not a coherent risk measure.

LO 54.6: Explain and calculate expected shortfall (ES), and compare and contrast VaR and ES.

LO 54.7: Describe spectral risk measures, and explain how VaR and ES are special cases of spectral risk measures.

Scenario Analysis

LO 54.8: Describe how the results of scenario analysis can be interpreted as coherent risk measures.

Binomial Trees

A One-step Binomial Model

LO 55.1: Calculate the value of an American and a European call or put option using a one-step and two-step binomial model.

The Replicating Portfolio

Using the Hedge Ratio to Develop the Replicating Portfolio

Synthetic Call Replication

Risk-neutral Valuation

Two-step Binomial Model

Assessing Volatility

LO 55.2: Describe how volatility is captured in the binomial model.

Modifying the Binomial Model

LO 55.4: Explain how the binomial model can be altered to price options on: stocks with dividends, stock indices, currencies, and futures.

American Options

Increasing the Number of Time Periods

LO 55.3: Describe how the value calculated using a binomial model converges as time periods are added.

The Black-Scholes-Merton Model

LO 56.1: Explain the lognormal property of stock prices, the distribution of rates of return, and the calculation of expected return.

LO 56.2: Compute the realized return and historical volatility of a stock.

Lognormal Stock Prices

Expected Value

Black-Scholes-Merton Model Assumptions

LO 56.3: Describe the assumptions underlying the Black-Scholes-Merton option pricing model.

Black-Scholes-Merton Option Pricing Model

LO 56.4: Compute the value of a European option using the Black-Scholes-Merton model on a non-dividend-paying stock.

Black-Scholes-Merton Model with Dividends

LO 56.8: Compute the value of a European option using the Black-Scholes-Merton model on a dividend-paying stock.

European Options

LO 56.7: Explain how dividends affect the decision to exercise early for American call and put options.

American Options

Valuation of Warrants

LO 56.5: Compute the value of a warrant and identify the complications involving the valuation of warrants.

Volatility Estimation

LO 56.6: Define implied volatilities and describe how to compute implied volatilities from market prices of options using the Black-Scholes-Merton model.

Greek Letters

Naked and Covered Call Options

LO 57.1: Describe and assess the risks associated with naked and covered option positions.

- naked call option: without owning the underlying asset

- covered call option: a short call option and the writer owns the underlying asset

A Stop-loss Strategy

LO 57.2: Explain how naked and covered option positions generate a stop loss trading strategy.

Delta Hedging

LO 57.3: Describe delta hedging for an option, forward, and futures contracts.

LO 57.4: Compute the delta of an option.

Dynamic Aspects of Delta Hedging

LO 57.5: Describe the dynamic aspects of delta hedging and distinguish between dynamic hedging and hedge-and-forget strategy.

Maintaining the Hedge

Other Portfolio Hedging Approaches

LO 57.6: Define the delta of a portfolio

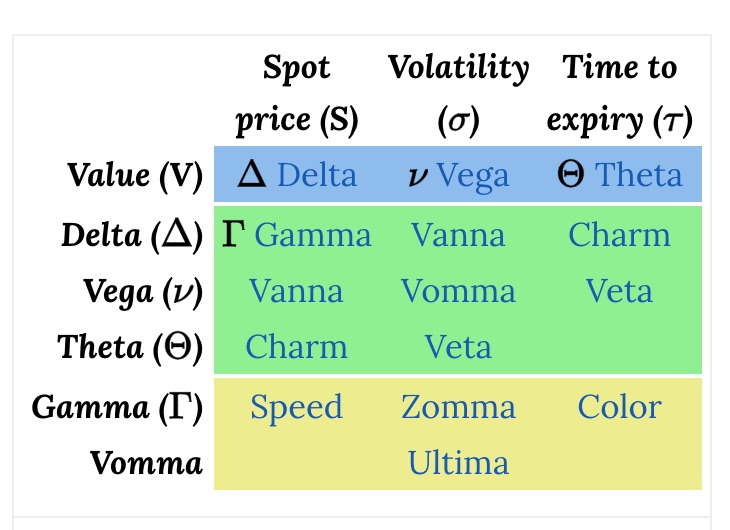

Theta, Gamma, Vega, and Rho

LO 57.7: Define and describe theta, gamma, vega, and rho for option positions.

LO 57.8: Explain how to implement and maintain a delta-neutral and a gamma-neutral position.

LO 57.9: Describe the relationship between delta, theta, gamma, and vega.

Theta

Gamma

Relationship Among Delta, Theta, and Gamma

Vega

Rho

Hedging in Practice

LO 57.10: Describe how hedging activities take place in practice, and describe how scenario analysis can be used to formulate expected gains and losses with option positions.

Portfolio Insurance

LO 57.11: Describe how portfolio insurance can be created through option instruments and stock index futures.

Prices, Discount Factors, and Arbitrage

Fundamentals of Bond Valuation

Calculating the Value of a Coupon Bond

Price-Yield Curve

Bond Price Quotations

Discount Factors

LO 58.1: Define discount factors and use a discount function to compute present and future values.

Determining Value using Discount Functions

LO 58.2: Define the “law of one price”, explain it using an arbitrage argument, and describe how it can be applied to bond pricing.

LO 58.5: Identify arbitrage opportunities for fixed income securities with certain cash flows.

Treasury Coupon Bonds and Treasury STRIPS

LO 58.3: Identify the components of a U.S. Treasury coupon bond, and compare and contrast the structure to Treasury STRIPS, including the difference between P-STRIPS and C-STRIPS.

Constructing a Replication Portfolio

LO 58.4: Construct a replicating portfolio using multiple fixed income securities to match the cash flows of a given fixed income security.

Computing Price between Coupon Dates

LO 58.6: Differentiate between “clean” and “dirty” bond pricing and explain the implications of accrued interest with respect to bond pricing.

LO 58.7: Describe the common day-count conventions used in bond pricing.

Accrued Interest

Day-Count Convention

Clean and Dirty Bond Pricing

Spot, Forward, and Par Rates

Annual Compounding vs. Semiannual Compounding

LO 59.1: Calculate and interpret the impact of different compounding frequencies on a bond’s value.

Holding Period Return

Deriving Discount Factors from Swap Rates

LO 59.2: Calculate discount factors given interest rate swap rates.

The Spot Rate Curve

LO 59.3: Compute spot rates given discount factors.

Forward Rates

LO 59.4: Interpret the forward rate, and compute forward rates given spot rates.

Par Rates

LO 59.5: Define par rate and describe the equation for the par rate of a bond.

Pricing a Bond using Spot, Forward, and Par Rates

LO 59.6: Interpret the relationship between spot, forward and par rates.

Effect of Maturity on Bond Prices and Returns

LO 59.7: Assess the impact of maturity on the price of a bond and the returns generated by bonds.

Yield Curve Shapes

LO 59.8: Define the “flattening” and “steepening” of rate curves and describe a trade to reflect expecations that a curve will flatten or steepen.

Returns, Spreads, and Yields

Realized Return

LO 60.1: Distinguish between gross and net realized returns, and calculate the realized return for a bond over a holding period including reinvestments.

Bond Spread

LO 60.2: Define and interpret the spread of a bond, and explain how a spread is derived from a bond price and a term structure of rates.

Yield to Maturity

LO 60.3: Define, interpret, and apply a bond’s yield-to-maturity (YTM) to bond pricing.

LO 60.4: Compute a bond’s YTM given a bond structure and price.

The Limitations of Traditional Yield Measures

LO 60.5: Calculate the price of an annuity and a perpetuity.

Calculating the Price of an Annuity

Calculating the Price of a Perpetuity

Spot Rates and YTM

LO 60.6: Explain the relationship between spot rates and YTM.

The Relationship between YTM, Coupon Rate, and Price

LO 60.7: Define the coupon effect and explain the relationship between coupon rate, YTM, and bond prices.

Coupon Effect

Return Decomposition

LO 60.8: Explain the decomposition of P&L for a bond into separate factors including carry roll-down, rate change, and spread change effects.

Carry-Roll-Down Scenarios

LO 60.9: Identify the most common assumptions in carry roll-down scenarios, including realized forwards, unchanged term structure, and unchanged yields.

One-Factor Risk Metrics and Hedges

Interest Rate Factors

LO 61.1: Describe an interest rate factor and identify common examples of interest rate factors.

Dollar Value of a Basis Point

LO 61.2: Define and compute the DV01 of a fixed income security given a change in yield and the resulting change in price.

- DV01: absolute change in bond price for every basis point change in yield, which is essentially a basis point’s price value

DV01 Application to Hedging

LO 61.3: Calculate the face amount of bonds required to hedge an option position given the DV01 of each.

Duration

LO 61.4: Define, compute and interpret the effective duration of a fixed income secruity given a change in yield and the resulting change in price

DV01 vs Duration

LO 61.5: Compare and contrast DV01 and effective duration as measures of price sensitivity.

- DV01 works better for hedgers, while duration is more convenient for traditional investors.

Convexity

LO 61.6: Define, compute, and interpert the convexity of a fixed income security given a change in yield and the resulting change in price

Price Change using both Duration and Convexity

Portfolio Duration and Convexity

LO 61.7: Explain the process of calculating the effective duration and convexity of a portfolio of fixed income securities.

Negative Convexity

LO 61.8: Explain the impact of negative convexity on the hedging of fixed income securities.

Constructing a Barbell Portfolio

LO 61.9: Construct a barbell portfolio to match the cost and duration of a given bullet investment, and explain the advantages and disadvantages of bullet versus barbell portfolios

Multi-Factor Risk Metrics and Hedges

Weakness of Single-factor Approaches

LO 62.1: Describe and assess the major weakness attributable to single-factor approaches when hedging portfolios or implementing asset liability techniques.

Key Rate Exposures

LO 62.2: Define key rate exposures and know the characteristics of key rate exposure factors including partial ‘01s and forward-bucker ‘01s.

Key Rate Shift Technique

LO 62.3: Describe key-rate shift analysis

Key Rate ‘01 and Key Rate Duration

LO 62.4: Define, calculate, and interpret key rate ‘01 and key rate duration

Hedging Applications

LO 62.5: Describe the key rate exposure technique in multi-factor hedging applications; summarize its advantages and disadvantages

LO 62.6: Calculate the key rate exposures for a given security, and compute the appropriate hedging positions given a specific key rate exposure profile.

Partial ‘01s and Forward-Bucket ‘01s

LO 62.7: Relate key rates, partial ‘01s and forward-bucket ‘01s, and caluclate the forward bucket ‘01 for a shift in rates in one or more buckets.

Hedging Across Forward-Bucket Exposures

LO 62.8: Construct an appropriate hedge for a position across its entire range of forward bucket exposures.

Estimating Portfolio Volatility

LO 62.9: Apply key rate and multi-factor analysis to estimating portfolio volatility.

Country Risk: Determinants, Measures and Implications

Sources of Country Risk

LO 63.1: Identify sources of country risk

Country Risk Exposure

LO 63.2: Explain how a country’s position in the economic growth life cycle, political risk, legal risk, and economic structure affect its risk exposure.

Evaluating Country Risk

LO 63.3: Evaluate composite measures of risk that incorporate all types of country risk and explain limitations of the risk services.

Sovereign Defaults

LO 63.4: Compare instances of sovereign default in both foreign curency debt and local currency debt, and explain common causes of sovereign defaults.

Consequences of Sovereign Default

LO 63.5: Describe the consequences of sovereign defaults.

Factors Influencing Sovereign Default Risk

LO 63.6: Describe factors that influence the level of sovereign default risk; explain and assess how rating agencies measure sovereign default risks.

The Sovereign Default Spread

LO 63.7: Describe the advantages and disadvantages of using the sovereign default spread as a predictor of defaults.

External and Internal Ratings

External Credit Ratings

LO 64.1: Describe external rating scales, the rating process, and the link between ratings and default.

LO 64.6: Describe a ratings transition matrix and explain its uses.

LO 64.2: Describe the impact of time horizon, economic cycle, industry, and geography on external ratings.

LO 64.3: Explain the potential impcat of ratings changes on bond and stock prices.

Evolution of Internal Credit Ratings

LO 64.4: Compare external and internal ratings approaches.

Internal Credit Ratings.

LO 64.5: Explain and compare the through-the-cycle and at-the-point internal ratings approaches.

LO 64.7: Describe the process for and issues with building, cailbrating and backtesting and internal rating system.

LO 64.8: Identify and describe the biases that may affect a rating system.

Capital Structure in Banks

Credit Risk Factors

LO 65.2: Identify and describe important factors used to calculate economic capital for credit risk: probability of default, exposure, and loss rate.

Expected Loss

LO 65.3: Define and calculate expected loss (EL).

- EL: EA PD LR

Unexpected Loss

LO 65.4: Define and calculate unexpected loss (UL).

- UL represents the variation in expected loss: $UL = EA \times \sqrt{PD \times \sigma{LR}^{2} + LR^{2} \times \sigma{PD}^{2}}$

LO 65.5: Estimate the variance of default probability assuming a binomial distribution.

Portfolio Expected and Unexpected Loss

LO 65.6: Calculate UL for a portfolio and the risk contribution of each asset.

Exonomic Capital

LO 65.1: Evaluate a bank’s economic capital relative to its level of credit risk.

LO 65.7: Describe how economic capital is derived.

Modeling Credit Risk

LO 65.8: Explain how the credit loss distribution is modeled.

- beta distribution is commonly used to model credit risk

LO 65.9: Describe challenges to quantifying credit risk.

Operational Risk

Defining Operational Risk

Operational Risk Capital Requirements

LO 66.1: Compare three approaches for calculating regulatory capital.

Operational Risk Categories

LO 66.2: Describe the Basel Committee’s seven categories of operational risk.

- clients, products, and business practices

- internal fraud

- external fraud

- damage to physical assets

- execution, delivery, and process management

- business disruption and system failures

- employment practices and workplace safety

Loss Frequency and Loss Severity

LO 66.3: Derive a loss distribution from the loss frequency distribution and loss severity distribution using Monte Carlo simulations.

Data Limitations

LO 66.4: Describe the common data issues that can introduce inaccuracies and biases in the estimation of loss frequency and severity distributions.

LO 66.5: Describe how to use scenario analysis in instances when data is scarce.

Forward-Looking Approaches

LO 66.6: Describe how to identify causal relationships and how to use risk and control self assessment (RCSA) and key risk indicators (KRIs) to measure and manage operational risks.

Scorecard Data

LO 66.7: Describe the allocation of operational risk capital to business units.

The Power Law

LO 66.8: Explain how to use the power law to measure operational risk.

Insurance

LO 66.9: Explain the risks of moral hazard and adverse selection when using insurance to mitigate operational risks.

Governance Over Stress Testing

Effective Governance and Controls over Stress Testing

LO 67.1: Describe the key elements of effective governance over stress testing.

Responsibilities of the Board and Senior Management

LO 67.2: Describe the responsibilities of the board of dirctors and senior management in stress testing activities.

Policies, Procedures, and Documentation

LO 67.3: Identify elements of clear and comprehensive policies, procedures, and documentations on stress testing.

Valuation and Independent Review

LO 67.4: Identify areas of validation and independent review for stress tests that require attention from a governance perspective.

Role of Internal Audits

LO 67.5: Describe the important role of the internal audit in stress testing governance and control.

Key Aspects of Stress Testing Governance

LO 67.6: Identify key aspects of stress testing governance, including stress testing coverage, stress testing types and approaches, and capital and liquidity stress testing.

Stress Testing and Other Risk Management Tools

The Role of Stress Testing

LO 68.1: Describe the relationship between stress testing and other risk measures, particularly in enterprise-wide stress testing.

Complementing Stress Tests with VaR Models

LO 68.2: Describe the various approaches to using VaR models in stress tests.

Stressed Input and Stressed VaR

LO 68.3: Explain the importance of stressed inputs and their importance in stressed VaR.

Stressed Risk Metrics Advantages and Disadvantages

LO 68.4: Identify the advantages and disadvantages of stressed risk metrics.

Principles for Sound Stress Testing Practices and Supervision

Stress Testing in Risk Management

LO 69.1: Describe the rationale for the use of stress testing as a risk management tool.

LO 69.2: Describe weakness identified and recommendations for improvement in:

- The use of stress testing and integration in risk governance

- Stress testing methodologies

- Stress testing scenarios

- Stress testing handling of specific risks and products